Marking one year since the election of President Trump

- 11.07.25

- Markets & Investing

- Commentary

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- This week’s election results carry limited read-through for midterm elections

- Air travel disruptions may push both parties to end the shutdown

- Betting odds lean in favor of Supreme Court striking down tariff authority

Super Moon! This week, skywatchers have been treated to a spectacular sight—the biggest and brightest supermoon of 2025, known as the Beaver Moon. Thanks to its close approach to Earth, this lunar wonder appears up to 30% larger and more luminous than usual, casting an extraordinary glow across night skies worldwide. While the moon shines above, we’re focusing on key developments here on Earth. It’s been one year since President Trump secured his second term, and we’re taking stock of how the economy and financial markets have performed during that time, highlighting both the wins and the challenges. Looking forward, several political events this week could shape the months ahead: off-year elections, the ongoing government shutdown, and the Supreme Court arguments on tariffs—all with potential implications for the economic and financial landscape. We detail our thoughts below.

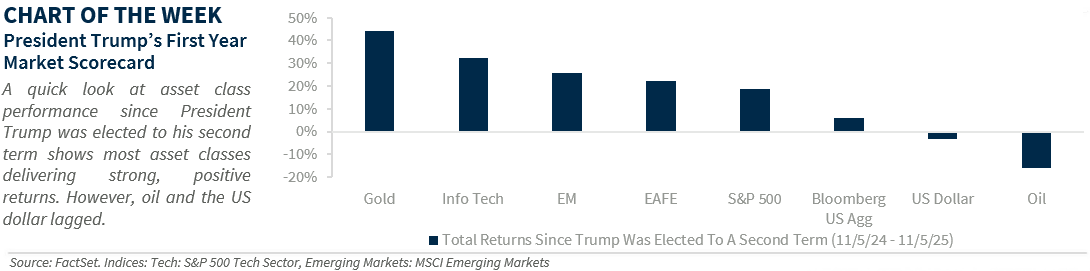

- Trump’s First-Year Scorecard | This week marks one year since President Trump was elected to the White House for a second, non-consecutive term. Despite bouts of volatility—especially after Liberation Day (April 2)—the economy and markets have held up better than many expected amid ongoing trade wars. Growth is on track to reach 1.8% in 2025, and while inflation remains elevated, it’s been milder than anticipated given the steepest tariff hikes in nearly a century. For investors, most major asset classes have extended last year’s gains: the S&P 500 is up +19%, S&P Tech sector +32%, EAFE +22%, MSCI EM +26%, Bloomberg Aggregate Bond Index +6.0.%, and gold is up an impressive 44% since Election Day. Notable laggards include oil, down 17%, and the US dollar, off 3%. These trends echo Trump’s first term—except for gold and oil. The downside: A prolonged government shutdown could add near-term economic risks to an already slowing backdrop—marked by weaker job growth, the highest October layoffs since 2003, and pressured consumer spending. It could also further weigh on his approval rating, which is already at its lowest level this year (+43% in RealClear Politics average).

- Early Read-Thru On Midterm Elections | This week’s gubernatorial races in Virginia and New Jersey, along with New York City’s mayoral election, offered an early glimpse into voter sentiment ahead of next year’s midterms. As expected, Democrats—who hold strong positions in these states—swept all three contests. Exit polls revealed that concerns about the economy and inflation remain top of mind for voters, signaling issues that could heavily influence the midterm outcome. Historically, the party out of power tends to gain ground in midterms, often seen as a referendum on the sitting president. While the clean sweep might hint at Democratic strength, it’s too early to draw firm conclusions with a full year to go. Economic dynamics could shift, especially as stimulus from the recent tax law takes effect and larger tax refunds arrive in 2026, potentially easing voter concerns. Potential redistricting in both Republican and Democratic-leaning states could also influence the outcome, and voter turnout will likely be higher in 2026. For more insights, check out our latest Q&A.

- The Government Shutdown | As the government shutdown enters its 38th day—the longest in history—the pressure to break the stalemate is intensifying. The impact is becoming increasingly visible: health care premium hike notices are going out, SNAP recipients are receiving only partial benefits (and the $4.5 billion contingency fund is only a short-term backstop), and furloughed employees remain unpaid. Travel disruptions are also mounting, with the FAA cutting flights at 40 major airports starting today—a significant move ahead of the busy holiday season. As we’ve noted before, once a shutdown begins to disrupt daily life, lawmakers typically become more willing to compromise. The big question now: what will finally bring both sides to the bargaining table? Markets expect a resolution before the Thanksgiving travel rush, and we hope it comes sooner. While past shutdowns haven’t left lasting scars on the economy or markets, the length of this one could deepen the Q4 slowdown we’ve been anticipating—though we still expect a healthy rebound in the new year.

- SCOTUS Questions The White House’s Authority On Tariffs | On Wednesday, the Supreme Court heard opening arguments in a case challenging the White House’s authority to impose tariffs under the International Emergency Economic Powers Act law. Seven of the nine justices signaled varying degrees of skepticism about using IEEPA for this purpose. That said, interpreting Supreme Court hearings can be tricky—what justices say doesn’t always predict how they’ll vote. Still, betting markets raised the odds of tariffs being struck down from 60% to 75% after the session. The big question: if these tariffs are overturned, does that mean all tariffs disappear? The answer is no. This case revolves around country-level tariffs—which comprise ~80% of the tariff revenue. The separate and distinct sectoral tariffs (autos, steel, etc.) are not at issue here, as they were based on formal trade investigations and appear on solid ground. If the country-level tariffs are struck down, the administration could reimpose the same tariffs under a different legal provision—or, alternatively, widen its use of sectoral tariffs. A secondary question before SCOTUS: If tariffs are struck down, will the Treasury have to refund those already paid? Probably yes. While that could offer a financial boost for some companies, the issue will likely be sent to lower courts, creating a lengthy and complex reimbursement process.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.